how to get rich book pdf

The pursuit of wealth fuels a massive market for books promising financial freedom, often available as a convenient PDF download. These resources tap into desires for prosperity, offering strategies and mindsets.

The Promise and the Reality

“Get rich quick” books, frequently found as downloadable PDFs, promise a straightforward path to financial independence. They often highlight success stories and simplified strategies, creating an illusion of easy wealth. However, the reality is far more complex; sustainable wealth requires diligent effort, informed decisions, and often, considerable risk.

Many books oversimplify financial principles, neglecting crucial details about market volatility and individual circumstances. While offering motivation, a PDF alone won’t guarantee riches.

Why People Seek Financial Freedom Through Books

The accessibility of “get rich” books, especially in PDF format, appeals to those seeking control over their financial destinies. Many desire escape from traditional employment or simply aspire to a more comfortable lifestyle. These books offer a perceived shortcut, promising knowledge and strategies to achieve these goals.

The allure lies in the belief that financial literacy, readily available, can unlock wealth, bypassing conventional barriers.

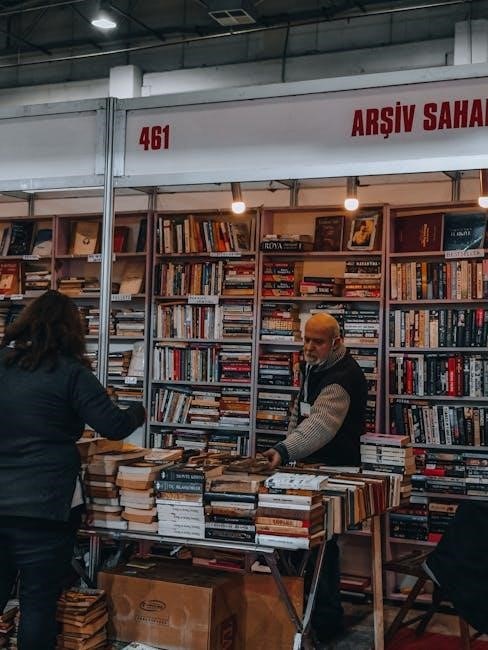

Understanding the Landscape of “Get Rich” Literature

“Get rich” books, often found as PDFs, share common themes like mindset shifts and investment strategies, but vary greatly in quality and legitimacy.

Common Themes and Strategies

Many “get rich” books, readily available as PDF downloads, emphasize the power of positive thinking and financial literacy as foundational elements. Recurring strategies include real estate investment, stock market participation, entrepreneurship, and developing multiple income streams. These texts often advocate for minimizing debt, maximizing savings, and understanding financial principles. However, a critical eye is crucial, as strategies vary in risk and suitability, and some PDFs may contain outdated or misleading information.

Identifying Legitimate Advice vs. Scams

Distinguishing credible financial advice from scams within “get rich” book PDFs requires diligence. Legitimate resources focus on building wealth through consistent effort and sound principles, avoiding unrealistic promises. Beware of PDFs guaranteeing rapid returns or pushing specific, unverified investment schemes. Look for authors with proven expertise and transparent methodologies; skepticism is vital when evaluating any “easy money” claims.

Popular “Get Rich” Books & Their Core Principles (PDF Availability)

Classic titles like “Rich Dad Poor Dad” and “Think and Grow Rich” are widely available as PDFs, offering diverse paths to financial literacy and wealth creation.

“Rich Dad Poor Dad” by Robert Kiyosaki

Kiyosaki’s influential work contrasts two father figures – one financially literate, the other not – to illustrate crucial money lessons. The book, frequently found as a PDF, emphasizes asset acquisition, financial intelligence, and escaping the “rat race.” It challenges conventional wisdom about money, work, and investing, advocating for building wealth through businesses and real estate. Understanding financial statements and leveraging debt responsibly are core tenets, making its PDF version a popular resource for aspiring investors.

“Think and Grow Rich” by Napoleon Hill

Hill’s classic, widely available as a PDF, distills success principles from interviews with prominent figures of his time. It centers on the power of positive thinking, visualization, and a burning desire to achieve financial goals. The book outlines thirteen principles, including auto-suggestion and specialized knowledge, emphasizing mindset as the foundation for wealth creation. Its enduring popularity stems from its focus on psychological factors and actionable steps.

“The Millionaire Next Door” by Thomas J. Stanley & William D. Danko

This book, often found in PDF format, challenges conventional wisdom about wealth, revealing that most millionaires live unassuming lives. Stanley and Danko’s research highlights frugality, disciplined spending, and long-term investing as key factors. They debunk the image of lavish lifestyles, emphasizing that building wealth is about accumulation, not display, offering a practical guide to financial independence.

Analyzing the Content: What Works and What Doesn’t

Effective books focus on financial literacy and actionable steps, while many PDFs overpromise and lack substance. Critical thinking is crucial for discerning value.

Focus on Mindset and Financial Literacy

Many “get rich” books, often found as downloadable PDFs, emphasize a positive mindset as foundational to wealth creation. However, mindset alone isn’t sufficient; genuine financial literacy is paramount. Understanding concepts like budgeting, investing, and debt management—often lacking in superficial guides—is essential.

Books that successfully blend psychological principles with practical financial education offer lasting value. They empower readers to make informed decisions, rather than chasing fleeting schemes.

The Importance of Actionable Steps

While “get rich” book PDFs may inspire, their true worth lies in providing actionable steps. Vague advice about positive thinking is insufficient; readers need concrete strategies for saving, investing, or starting a business.

Effective books outline specific tasks and encourage consistent effort. Without practical application, even the most compelling theories remain unrealized potential, failing to deliver promised results.

Finding Reliable PDF Versions of These Books

Locating legitimate PDF copies requires caution, prioritizing legal sources to avoid piracy and potential malware risks associated with unofficial downloads.

Legal Sources for Download

Accessing “get rich” books in PDF format legally often involves purchasing them through official online bookstores like Amazon Kindle, Google Play Books, or directly from the publisher’s website. Many libraries also offer digital lending programs, providing free access to ebooks, including financial literacy titles. Project Gutenberg, while not focused solely on these books, may contain older, public domain works related to wealth-building principles. Subscriptions to online learning platforms sometimes include downloadable PDFs as part of their course materials, offering a structured learning experience alongside the book itself.

Avoiding Piracy and Malware Risks

Downloading “get rich” book PDFs from unofficial sources carries significant risks, including copyright infringement and exposure to malware. These sites often host viruses disguised as ebooks. Piracy supports illegal activities and undermines authors. Always prioritize legitimate platforms to safeguard your device and data. Be wary of sites promising free downloads of copyrighted material; they frequently compromise your security for financial gain, potentially leading to identity theft.

The Role of Structured Data & Rich Results in Book Promotion

Implementing schema markup for “get rich” book PDFs enhances search visibility, enabling rich snippets and improved rankings. This attracts more organic traffic to your site.

Google Search Console & Rich Snippets

Google Search Console reports validate structured data implementation for your “get rich” book PDF pages. Properly formatted schema allows Google to display rich snippets – enhanced search results featuring book details like author, rating, and price. These visually appealing snippets significantly boost click-through rates, driving targeted traffic to your downloadable PDF offers. Monitoring Search Console identifies and resolves errors, ensuring maximum visibility and impact of your rich results.

Utilizing Schema Markup for Book PDFs

Implementing schema markup is crucial for “get rich” book PDFs. Use Book schema to define title, author, ISBN (if applicable), and download URL. Add digitalContentSection specifying the PDF format. This structured data helps search engines understand your content, enabling rich snippets. Validate your schema using Google’s Rich Results Test to avoid errors and maximize search visibility for your downloadable PDFs.

Rich Media & Advertising Strategies for Book Sales

Leverage video summaries and interactive previews of “get rich” book PDFs. Targeted ads showcasing success stories and downloadable samples drive conversions effectively.

Leveraging Video and Interactive Content

Short, engaging videos summarizing key principles from “get rich” book PDFs can dramatically increase interest and sales. Interactive elements, like quizzes testing financial literacy or downloadable worksheets based on the book’s content, boost engagement. Consider animated explainers of complex concepts. Showcase testimonials and success stories related to applying the book’s strategies. Interactive PDFs with embedded videos and clickable links further enhance the user experience, driving conversions and establishing authority.

Targeting the Right Audience

Focus advertising for “get rich” book PDFs on individuals actively seeking financial improvement. Utilize demographics like age, income, and education level. Target interests including investing, entrepreneurship, and personal finance. Platforms like Facebook and Google Ads allow precise audience segmentation. Consider retargeting website visitors who showed interest in related content. Address feelings of disparity, acknowledging wealth inequality, to resonate with potential readers seeking solutions.

Cultural Considerations & Financial Advice

Financial strategies within “get rich” book PDFs must acknowledge global economic differences, like challenges faced in China. Adapting advice to local contexts is crucial for relevance.

Global Economic Differences (e.g., China)

“Get rich” book PDFs often lack nuanced understanding of diverse economic landscapes. For example, China’s unique pressures – like meat accessibility due to pig farming challenges – impact financial strategies.

Simply translating Western advice doesn’t work; considering population density and historical context is vital. Enlightenment ideals may resonate differently, requiring culturally sensitive adaptation for effective implementation and understanding within Chinese society.

Adapting Strategies to Local Contexts

PDF “get rich” guides require significant localization. A blanket approach ignores regional financial infrastructures and societal norms. Consider how limited roles in smaller towns constrain opportunity. Strategies must acknowledge disparities between wealth classes and address feelings of inequality. Ignoring local hierarchies and economic realities renders advice ineffective, even harmful, globally.

RCS Messaging & Book Marketing

RCS enables interactive book promotions, delivering rich media and engaging content directly to potential readers’ smartphones, boosting PDF sales. It’s a dynamic approach.

Utilizing Rich Communication Services

RCS messaging transcends traditional SMS, offering enhanced features ideal for promoting “get rich” book PDFs. Interactive cards can showcase author bios, sample chapters, and direct download links. Businesses can leverage carousels to highlight related titles, fostering a more engaging experience. RCS supports rich media – images and videos – capturing attention and driving conversions. Personalized messages, tailored to user interests, further amplify impact, ultimately boosting PDF sales and readership.

Engaging Readers Through Interactive Messages

Interactive RCS messages can dramatically boost “get rich” book PDF engagement. Quizzes testing financial literacy, polls gauging interest in specific wealth-building strategies, and clickable calls-to-action for immediate PDF downloads are effective. Offer exclusive excerpts or bonus content accessible via message replies. Gamification, like reward points for sharing, encourages virality. These features foster a community and drive conversions beyond static advertising.

The Psychological Impact of Wealth & Inequality

“Get rich” books, even in PDF form, can exacerbate feelings of disparity. Awareness of wealth gaps and societal hierarchies impacts motivation and self-perception.

Addressing Feelings of Disparity

Exposure to “get rich” book content, particularly in accessible PDF formats, can intensify feelings of inadequacy or envy. Recognizing that success is multifaceted—not solely financial—is crucial. These books often highlight exceptional cases, creating unrealistic expectations. Cultivating gratitude, focusing on personal growth, and understanding systemic inequalities are vital counterbalances. Acknowledging privilege and actively supporting equitable opportunities can mitigate negative psychological effects, fostering a healthier perspective on wealth and ambition.

The Role of Enlightenment Ideas

Historically, Enlightenment ideals of self-improvement and rational thought underpin many “get rich” philosophies, even those distributed as PDFs. However, contemporary interpretations often prioritize individual gain over collective well-being. Critically examining how these ideas are applied—and whether they perpetuate inequality—is essential. Recognizing the historical context and potential distortions of Enlightenment principles fosters a more nuanced understanding of wealth-building strategies.

Evaluating the Long-Term Value of “Get Rich” Books

While PDFs offer accessible advice, sustainable wealth requires consistent effort and critical thinking, moving beyond quick schemes presented in many popular guides.

Building Sustainable Wealth

Genuine wealth creation, unlike promises within a “get rich quick” book PDF, demands a long-term perspective and disciplined financial habits. It’s about consistent investment, diversified income streams, and adapting strategies to evolving economic landscapes.

Focusing on financial literacy, avoiding excessive risk, and understanding market dynamics are crucial. Sustainable wealth isn’t built on fleeting trends but on solid foundations of knowledge and prudent action.

Beyond Quick Schemes

While “get rich quick” book PDFs may offer initial inspiration, lasting financial success transcends simplistic solutions. True prosperity requires diligent effort, continuous learning, and a realistic understanding of market complexities.

Rejecting get-rich-quick fantasies and embracing a mindset of long-term value creation is essential. Focus on building skills, providing value, and fostering financial resilience – the cornerstones of enduring wealth.

The Importance of Critical Thinking

Evaluating “get rich” book PDFs demands skepticism. Question claims, verify assumptions, and conduct thorough due diligence before implementing any financial advice or investment strategies.

Questioning Assumptions and Claims

When encountering “get rich” book PDFs, critically assess underlying assumptions. Does the author’s success guarantee your own? Beware of unrealistic promises and anecdotal evidence presented as universal truths. Scrutinize claims of effortless wealth; legitimate financial strategies require consistent effort and risk management. Consider the author’s motivations and potential biases before accepting their advice as gospel.

Due Diligence Before Investing

Before acting on advice from a “get rich” book PDF, conduct thorough due diligence. Research the author’s background and verify their credentials. Independently investigate any investment opportunities mentioned, checking for legitimacy and potential scams. Don’t rely solely on the book’s information; seek advice from qualified financial professionals. Protect yourself from predatory schemes promising quick returns.

JSON-LD and Rich Results Testing

Validate structured data for book PDFs using Google’s Rich Results Test tool. Ensure accurate schema markup implementation to enhance search visibility and attract readers.

Validating Structured Data

Thoroughly test JSON-LD implementation for “get rich” book PDFs using Google’s Rich Results Test; This crucial step confirms accurate schema markup, ensuring Google Search understands book details like author, ISBN, and availability. Ignoring comments within the code is vital, as the standard doesn’t support them. Valid data unlocks rich snippets, boosting visibility and attracting potential readers seeking financial guidance in PDF format.

Avoiding Errors in Implementation

Carefully review JSON-LD code for “get rich” book PDFs, ensuring syntax accuracy and adherence to schema.org guidelines. Incorrect markup prevents rich results. Validate data frequently using Google’s testing tool. Prioritize clean code, removing unnecessary characters or comments. Errors hinder search visibility and diminish the impact of your book’s PDF promotion efforts, impacting potential readership.

The Future of Financial Literacy Resources

Online learning and evolving content formats will reshape financial education, with accessible PDF guides and interactive tools becoming increasingly prevalent for all.

Emerging Trends in Online Learning

Microlearning modules, delivered via accessible PDF resources, are gaining traction, offering bite-sized financial lessons. Interactive simulations and personalized learning paths, often supplementing “get rich” book PDFs, cater to diverse learning styles. Gamification and community forums enhance engagement, fostering a supportive environment. The integration of AI-powered tools provides customized financial advice, while blockchain technology ensures secure access to educational materials and verifiable credentials;

The Evolution of “Get Rich” Content

Initially focused on traditional methods, “get rich” content, including downloadable PDF guides, now embraces digital finance. Cryptocurrency, NFTs, and online businesses feature prominently. Content creators leverage video, podcasts, and interactive platforms. Emphasis shifts from passive reading of PDF books to active implementation and community-driven learning. Accessibility via mobile devices and diverse formats expands reach, while personalized advice gains importance.

While “get rich” books, often found as PDF downloads, offer valuable insights, sustainable wealth requires critical thinking and diligent effort. Avoid solely relying on quick schemes. Combine knowledge from various sources with practical action, adapting strategies to individual circumstances. Financial literacy is a journey, not a destination, demanding continuous learning and responsible decision-making.